The mortgage terms were so ludicrous that a borrower with no credit history, a horrible credit rating, a history of never paying money back, and no cash to put down could borrow 110% of the purchase price of a house. "The underwriting standards just plummeted. Here are Paulson's 11 best quotes from the interview, lightly edited and condensed for clarity:ġ.

' Housing over Time and over the Life Cycle: A Structural Estimation ,' Departmental Working Papers 2014-12, Department of Economics, Louisiana State.

Fang Yang & Wenli Li & Haiyong Liu & Rui Yao, 2014.

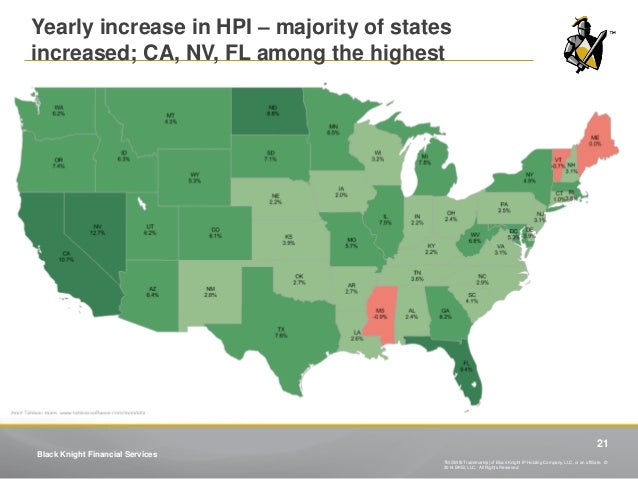

#Map of mortgage defaults 2008 series

He also touched on his philanthropic pursuits, and offered some advice for young people choosing a career. 'The rise in mortgage defaults,' Finance and Economics Discussion Series 2008-59, Board of Governors of the Federal Reserve System (U.S.). residents under the Mortgage Assistance Program (MAP). Paulson discussed shorting a slew of Wall Street banks, mortgage lenders, and credit-rating agencies during the mid-2000s housing boom. As of June 30, 2008, over 134,000 subprime loans were on the books in. His wager was immortalized in the book "The Greatest Trade Ever: The Behind-the-Scenes Story of How John Paulson Defied Wall Street and Made Financial History." The billionaire investor - who converted his Paulson & Co hedge fund into a family office last year - detailed how he anticipated the housing market's collapse, shorted about $25 billion of securities, and scored a $15 billion windfall. John Paulson explained his famous bet against the US housing bubble in a recent episode of Finanze, a podcast hosted by Logan Lin, a 17-year-old student at a California high school.

0 kommentar(er)

0 kommentar(er)